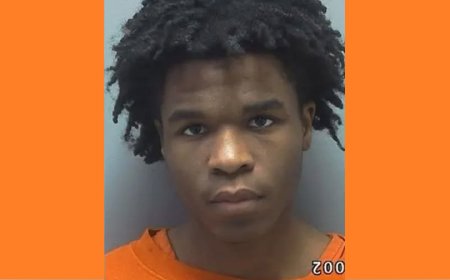

Ex-bank officer Randy Jones in Ga. pleads guilty to charges

GAINESVILLE, Ga. -- A former Georgia bank executive pleaded guilty Thursday to using customers and family members to orchestrate a multimillion dollar fraud conspiracy, the most recent sign of a ramped-up effort by federal officials against bank fraud in Georgia.

Randy Jones, 50, could face decades in prison after he pleaded guilty to receiving kickbacks for real estate loans while he was an executive vice president at Community Bank & Trust, the failed Coelia-based bank where he worked for 30 years.

"I agree that the govement would have enough facts to prove a conspiracy," a solemn Jones said at the court hearing.

Jones' guilty plea comes amid increased federal scrutiny of bank fraud in Georgia, home to more bank failures during the financial crisis than any other state. Some 52 banks have failed in Georgia since 2008, and many of them were smaller banks headquartered in metro Atlanta and north Georgia.

U.S. Attoey Sally Quillian Yates, the region's chief federal prosecutor, said after she took office last year that prosecutors have opened criminal investigations into several bank failures and that cracking down on those fraud schemes would be among her top priorities.

Georgia Attoey General Sam Olens said he's preparing legislation that would give him authority to launch investigations into foreclosure fraud. And Federal Deposit Insurance Corp. investigators slapped a key state legislator and seven others with a lawsuit this month, seeking $70 million in damages for their alleged roles in another failed bank.

Unlike some of the other failed banks in Georgia, CB&T was no fly-by-night operation. It opened in 1900 and has been insured with the FDIC since 1934, growing to operate 36 branches across the region. Fueled by real estate and construction loans, the bank had $1.1 billion in assets and 400 employees when regulators shut it down in January 2010.

But regulators say the bank's balance sheets weren't as buoyant as they seemed. An FDIC report in September accused the bank of failing to follow its own loan policy, and claimed that one unnamed senior officer alone was responsible for more than $10 million in bad loans.

Jones, prosecutors say, was emblematic of the bank's problems.

He is accused of doling out loans to a customer, Joseph Penick Jr., to buy tracts of land in north Georgia, and then financing transactions to another customer at inflated prices. Prosecutors say Penick paid Jones more than $770,000 for a pair of deals. Penick, meanwhile, has already pleaded guilty for his part in the scheme.

But authorities say Jones didn't stop there.

Investigators say he used the names of family members without their consent to obtain more than $800,000 in loans from the bank, which he used to buy a stake in six Zaxby's restaurants. And they claim he approved more than $2.8 million in loans to fraudulent borrowers so that a customer who was a real estate developer could pay down interest on loans.

Jones becomes is one of the most prominent casualties of the banking crisis in Georgia. But he isn't the only one.

Five people with ties to Atlanta-based Omni National Bank were convicted on bank fraud and other charges after the bank collapsed amid a federal mortgage fraud probe.

And the FDIC's lawsuit accuses former officers of Alpharetta-based Integrity Bank of gross negligence and breaching fiduciary duty for making bad loans. Among others, it names state Sen. Jack Murphy, the new chairman of the Georgia Senate Banking Committee and a former bank official.

Murphy said in a statement Thursday that he has done nothing wrong and has no plans to step aside, contending that "I not only followed the letter of the law but the spirit of the law as well."

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0