Indicted ex-Chesapeake CEO and Oklahoma NBA team owner Aubrey McClendon dies in fiery single-car crash

Former Chesapeake Energy Corp CEO Aubrey McClendon has died in a car crash less than 24 hours after being indicted on conspiracy charges.

The crash happened Wednesday moing around 9am in Oklahoma City, Oklahoma when the 56-year-old's car struck an overpass bridge.

Authorities held a press conference later in the day to confirm the victim's identity.

'He pretty much drove straight into the wall. There was plenty of opportunity to correct or go back to the roadway. That didn't occur,' police Capt. Paco Balderrama said, adding that McClendon was driving well over the 40mph speed limit.

McClendon's 2013 Chevrolet Tahoe was engulfed in flames in the crash and so badly bued that it was impossible to know whether McClendon was wearing his seat belt at the time.

Police would not say whether the death was a suicide or not yet. The crash remains under investigation and authorities say it will be at least two weeks until more information is released.

Balderamma says it is 'possible' that McClendon could have suffered some sort of medical event.

He was supposed to tu himself into jail at 11am.

McClendon is survived by his wife Katie - a Whirlpool heiress and relative of model Kate Upton - and their three adult children Jack, Callie and Will.

He was a part owner of the Oklahoma City Thunder and the great-nephew of former Oklahoma goveor and U.S. Senator Robert Kerr.

He founded Chesapeake Energy with business partner Tom Ward in 1989 when he was 29 years old, but was forced to leave the company in 2013 amid a shareholder revolt over.

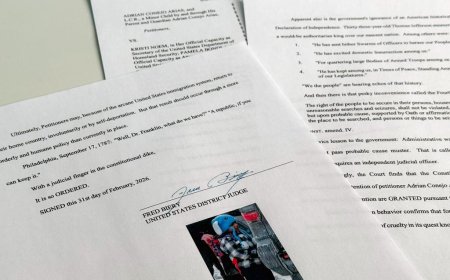

McClendon was charged on Tuesday with conspiring to rig bids to buy oil and natural gas leases in the state.

The incident happened early Wednesday moing in Oklahoma City, Oklahoma. It has not been confirmed yet whether or not his death was a suicide

'He pretty much drove straight into the wall' at a 'high rate of speed,' Oklahoma City POlice Capt Paco Balerrama said.

The indictment follows a nearly four-year federal antitrust probe that began after a 2012 Reuters investigation found that Chesapeake had discussed with a rival how to suppress land lease prices in Michigan during a shale-drilling boom.

Although the Michigan case was subsequently closed, investigators uncovered evidence of alleged bid-rigging in Oklahoma.

In addition to the federal probe, the Michigan attoey general brought criminal charges against Chesapeake, which the company settled in 2015 by agreeing to pay $25 million into a compensation fund for land owners.

McClendon was a shale drilling evangelist who was once among the highest paid U.S. CEOs. He co-founded Chesapeake with fellow Oklahoma oilman Tom Ward in 1989. In 2013, McClendon stepped down from the helm of Chesapeake amid a liquidity crunch and corporate goveance conces. Ward left Chesapeake in 2006 and founded competitor SandRidge Energy Inc the same year.

McClendon, who was with American Energy Partners (AEP) at the time of his death, was charged with one count of conspiracy to rig bids, a violation of the Sherman Antitrust Act, the Justice Department said.

'The charge that has been filed against me today is wrong and unprecedented,' McClendon said in statement, after the charges were filed. 'I have been singled out as the only person in the oil and gas industry in over 110 years since the Sherman Act became law to have been accused of this crime in relation to joint bidding on leasehold.'

McClendon was a part owner of the Oklahoma City Thunder. Pictured above attending a game in 2012 with his wife Katie, who is a relative of Kate Upton

Chesapeake itself is unlikely to face criminal prosecution, the company said.

'Chesapeake has been actively cooperating for some time with a criminal antitrust investigation by the Department of Justice regarding past land leasing practices,' said Chesapeake Energy spokesman Gordon Pennoyer. 'Chesapeake does not expect to face criminal prosecution or fines relating to this matter.'

Chesapeake shares declined 3.6 percent in after-hours trading to $2.66

The seven-page indictment alleges that McClendon set up a conspiracy of two energy companies which agreed not to bid against each other in purchasing oil and natural gas leases in northwest Oklahoma from 2007 to 2012. The indictment did not name either company.

The indictment comes at a time when energy executives across America are already facing considerable distress. Oil and gas companies like Chesapeake, SandRidge, and McClendon's new venture AEP, have struggled as the price of oil plummeted by 70 percent since late 2014.

Aubrey McClendon pictured center with his son Will, right, and wife Katie

Both Chesapeake and SandRidge, once storied firms in Oklahoma's oil industry, have recently engaged restructuring experts as they scramble to pay off billions in debt and avoid potential bankruptcy. Chesapeake's stock price has tumbled more than 80 percent in the last year. SandRidge was delisted from the New York Stock Exchange in January, and closed Tuesday at 4 cents per share.

Much of the companies' debt was accrued in the period from 2007 through 2012 when McClendon was allegedly engaged in an antitrust conspiracy, a time when Chesapeake was snapping up millions of acres of land leases nationwide to expand its shale drilling.

McClendon was also embroiled in a lawsuit with Chesapeake which alleged that he took sensitive company data from his former company to build his new business.

The Justice Department said that McClendon's indictment was the first case in an ongoing federal antitrust investigation into price fixing, bid rigging and other anti-competitive conduct in the oil and natural gas industry.

'His actions put company profits ahead of the interests of leaseholders entitled to competitive bids for oil and gas rights on their land. Executives who abuse their positions as leaders of major corporations to organize criminal activity must be held accountable for their actions,' said Assistant Attoey General Bill Baer, head of Justice Department's Antitrust Division.

Chesapeake, SandRidge, and McClendon had previously disclosed in securities filings that they were being investigated by the Justice Department's Antitrust Division.

MIXING PRIVATE AND PROFESSIONAL: REPORT FROM 2012 DETAILS MCCLENDON'S LEADERSHIP AT CHESAPEAKE

In the 2012 Reuters report on McClendon, it was also revealed that Chesapeake had an entire office within the company dedicated to managing McClendon's personal business.

According to inteal documents reviewed by Reuters, the 'AKM Operations's' accountants, engineers and supervisors handled about $3 million of personal work for McClendon in 2010 alone. Among other tasks, the unit's controller once helped coordinate the repair of a McClendon house that was damaged by hailstones.

The report also revealed that the company's fleet of planes were being used by the McClendon family for personal holidays.

On one trip, the clan took flights to Amsterdam and Paris that cost $108,000; McClendon counted the trip as a business expense.

In another case, Chesapeake logs show, nine female friends of McClendon's wife flew to Bermuda in 2010 without any McClendons aboard. The cost: $23,000.

McClendon's vested interest in the Oklahoma City Thunder, which he partially owned, was also detailedin the report which showed that Chesapeake signed a $36 million sponsorship deal, and it paid up to $4 million annually to brand the stadium Chesapeake Energy Arena.

McClendon also mortgaged his future proceeds from the team to secure two bank loans.

McClendon, 52, put longtime friends on the Chesapeake board and showered them with compensation.

Beyond the mixing of personal and professional, another theme emerged from interviews and records: McClendon's seemingly insatiable desire to own more and more - of everything.

Said a contemporary who knows McClendon well, 'If you're competitive like Aubrey, you just always want to own more.'

For Chesapeake, McClendon has overseen a spree of more than 100 real estate purchases in Oklahoma City worth more than $240 million, property records show. On land steps from the corporate campus, he directed his natural gas company to develop a luxury shopping center.

For himself, McClendon bought his neighbor's house near Oklahoma City and then the one behind that. He acquired a mansion on 'billionaire's row' in Bermuda and later added a larger estate. He bought properties in Minnesota and Maui and near Vail, Colorado. He filled cellars in three states with trophy wines, and purchased 16 antique boats valued at $9 million.

Then McClendon mortgaged much of it - and bought more.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0